Liverpool Property Investment Diary

The purpose of this Liverpool Property Investment Diary is to assist buy to let investors with understanding some of the detail, the successes and also the frustrations of being a property investor, particularly in Liverpool and Wirral, though almost all of the content will be familiar to any real estate investor worldwide.

I will also look at aspects of property sourcing in Liverpool and our approach to renovation and refurbishment projects and also the Buy, Refurb, Refinance, Rent (BRRR) portfolio building strategy.

I will also look at distressed assets, off-market deals, and property auctions, the very subject of my book below.

The content and narrative will be similar to my Amazon bestselling book, "Property Auctions: Repossessions, Bankruptcies and Bargain Properties (2023) published by Hamster Publishing

-----------------------------------------------------------------

Monday 12th June 2023

A good day to start writing this Liverpool property investment diary. The day started by collecting keys for some off-market buy-to-let properties in the Bootle (L20) area. The owner is keen to sell and we have investors keen to buy. Our job is to find a price which accommodates both sides. The estimated yields are well into double digits at the prices I have in mind, and which have already had tacit approvable from the seller.

Property Management Liverpool

On the property management side, during a regular inspection, we discovered Japanese knotweed at a property and instructed a professional company to deal with it. It's important to note that it must be dealt with professionally and normally takes a number of site visits. Pulling it up yourself is not dealing with it.

What is Japanese Knotweed?

The major concern with Japanese knotweed is its ability to cause damage to infrastructure and property. Its extensive underground root system can penetrate foundations, pipes, and asphalt, leading to costly repairs. Due to its resilience, eradicating Japanese knotweed can be challenging, and professional removal methods are often necessary.

In the United Kingdom, Japanese knotweed is considered a controlled or regulated plant due to its invasive nature. It is important to properly manage and dispose of Japanese knotweed to prevent its spread and mitigate its impact on the environment. If you suspect the presence of Japanese knotweed, it is advisable to consult local authorities or specialists for appropriate guidance and treatment options.

-----------------------------------------------------------------

Distressed Assets

Wednesday 14th June 2023

We received the first quote back for treating the Japanese Knotweed. A 5 year programme with a 10 year guarantee. Not cheap, but it needs to be dealt with professionally.

We had an offer accepted for an off-market buy to let property in Wallasey. The yield is exceptional, well into double digits. It is a refurbishment project and the owner was motivated to sell.

Option Agreement

We also have prices agreed on two properties in Bootle which we viewed on Monday. They will be sold with the benefit of an option agreement. This is an excellent way in which to secure properties quickly.

What's a property option agreement?

A property option agreement, also known as a real estate option agreement, is a specific type of option agreement that relates to the purchase or sale of property or land. It is a legal contract between a property owner (option grantor) and a potential buyer (option holder) that grants the holder the exclusive right to buy or sell the property within a specified period of time, at a predetermined price.

In a property option agreement, the option holder pays an option fee or premium to the property owner for the right to exercise the option. The fee is usually non-refundable and serves as consideration for the option itself. The terms and conditions of the agreement outline the purchase price, the duration of the option period, any conditions or contingencies that must be met, and other relevant details.

The key advantage of a property option agreement is that it provides the option holder with control and flexibility. It allows them to secure the right to purchase the property at a later date, typically at a predetermined price, while they assess its value, obtain financing, or carry out due diligence. It also enables property owners to lock in a potential buyer and ensure a sale, even if the transaction does not occur immediately.

Property option agreements are commonly used in real estate development, where developers secure options on properties for future development projects. They can also be employed by individuals or investors looking to buy or sell a specific property but require more time or additional information before committing to the transaction.

Property Auctions: Repossessions, Bankruptcies and Bargain Properties

My new book, which was published in March 2023, is an Amazon bestseller and is now also an audiobook on Amazon, Audible and iTunes. To purchase the book, please visit Amazon.

Sunday 18th June 2023

I always use Sunday morning to reflect on the previous week and look forward to the next in some detail, particularly when we're very busy.

Last week we acquired three properties for completion in the coming month or so and also received enquiries from landlords wanting to sell off-market to our client base. I know the properties well, as we manage them, so will look at the prices later this morning.

We are completing tomorrow on three properties from last month's auction. One is tenanted, one needs some work to get tenanted, and the other is a 'full hit' renovation project. In all three cases, the clients are looking to pull out some cash through the BRRR method and buy more. Our mortgage advisor, Josh, is guiding them through the bridging and mortgage maze - successfully.

Client visit

Many of our clients live overseas or outside the immediate Liverpool area. Next week we have a couple of visits from clients who are seeing their properties for the first time. In one case, we will undertake a site visit to discuss the merits of converting the property into apartments to increase yield. It was acquired at auction recently and has great potential for any use. As a house, it's a 9% yield, but as apartments, we could get a better return, but that has to be weighed against conversion costs and 'payback.'

What is payback?

The term payback refers to the time it takes to recover the cost of an investment. It is the length of time an investment reaches a breakeven point.

Off-Market Property Deals Liverpool

An off-market deal is never advertised; otherwise, it's not 'off-market.' Some estate agents use the term as another form of marketing, whether to WhatsApp groups, e-mail lists or clubs. It gives the impression that it's exclusive, but it's probably being sent to hundreds or thousands of investors looking for a bite.

At Tuna Fish Property, we receive off-market opportunities often, three last week, for instance, but they are never advertised. We take them ourselves or place them with a client via a telephone call or Zoom. They are never sent out to a database.

2023 - the year of distressed assets

As interest rates rise, some sellers become distressed, needing to sell their investment properties quickly in order to obtain cash and reduce debts. These sellers will often take a capital hit for a quick sale, and our role is to facilitate and arrive at a price at which both parties are satisfied.

As we move into 2024, distressed sales will increase, replicating the market of 2008-2012, as I discuss in the book.

-----------------------------------------------------------------

Liverpool Rental Market

Tuesday 20th June 2023

Rents

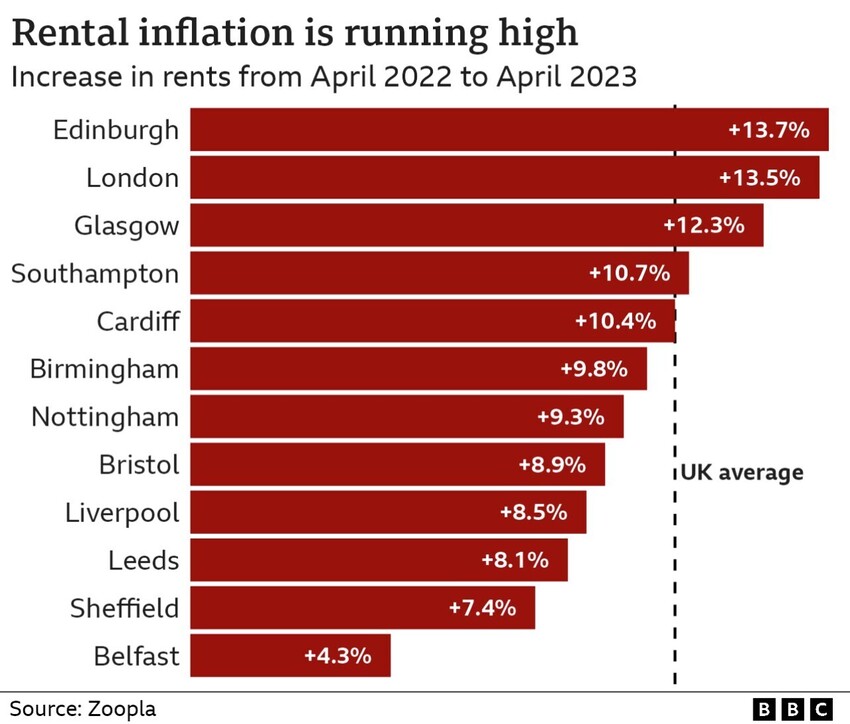

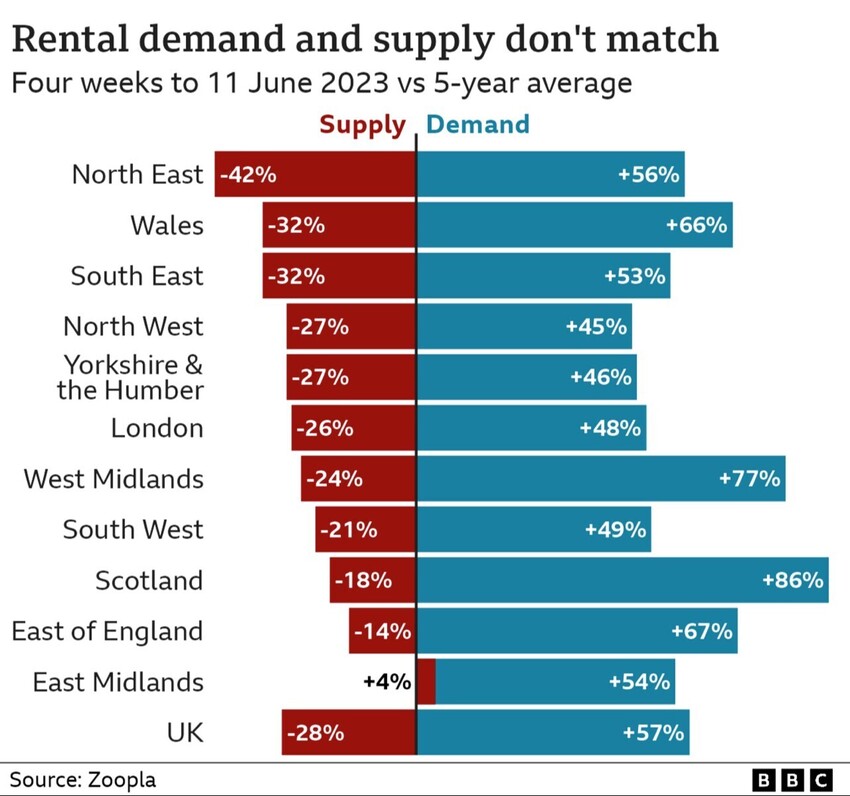

The typical tenant in the UK now allocates over 28% of their pre-tax income towards rent. This indicates that tenants are dedicating a larger portion of their earnings to rental payments than at any point in the past decade, as reported by property portal Zoopla. Additionally, average rents for new leases have surged by 10.4% within a year.

Liverpool Rental Market

We have seen buy to let rents rise significantly in Liverpool and Wirral. Zoopla is reporting an 8.5% average increase over the past 12 months, with £765 per calendar month.

As with averages, some rent increases will be above, and others below. Tuna Fish Property has recently undertaken a portfolio-wide rental review with increases above 10%.

------------------------------------------------------------------

Thursday 22nd June 2023

The inflation figures were disappointing yesterday, and the Bank of England's Monetary Policy Committee (MPC) meets later today. It's highly probable that it will raise the bank rate, which will then affect buy to let variable mortgage rates.

The trend with our property investors in Liverpool has been to de-leverage. Some only buy for cash, whilst others buy, bridge and then opt for 50% loan-to-value (LTV). The key clearly is not to enter negative cashflow.

Protecting cashflow in a rising interest rate environment

Rent Reviews

It's incredible how many buy to let investors do not undertake regular rent reviews. I looked at a distressed property yesterday which is renting for £500 per calendar month, while the market rent is a whopping £800 per calendar month! Increasing income, offsets increasing costs.

Letting Agents

It should go without saying, but move to a low costs letting agent. Look at both the headline rates and the small print and also the average cost of repairs. You can save a small fortune. Please give the office a call to see how we can help you - Contact Us

The Bank increased base rates by 50 basis points or 0.5% which is double its previous hikes, which underlies the difficulty it is having in controlling inflation.

-----------------------------------------------------------------

Liverpool Property Auctions

Saturday 24th June 2023

Started putting together some options for the next property auctions in Liverpool in mid-July. I start by looking at all the lots, and dismissing many based on location and price. The fact that a property is in an auction does not mean it's necessarily good value. Some buy to let investors and homeowners are behind the curve with current-day pricing, and its not unusual to see a large number of unsold lots, reappearing in another auction at a lower guide price.

The skill with buying at auction, which I discuss in depth in my book, is sorting the wheat from the chaff. It's time-consuming, but it's a must if you want to be a successful auction buyer.

Monday 26th June 2023

My new book, published in March 2023, reached official No.1 Amazon Bestseller status over the weekend. It is very satisfying, but also the timing is interesting.

At Tuna Fish, we have seen a sharp rise in enquiries for Liverpool property investment and the surrounding areas in Merseyside and Wirral. It is a similar effect to what we saw in 2008/2009, which I detail in the book.

As some buy to let investors exit the market, others replace them. These investors, in some cases, are new to property investment and have been waiting in the wings. Others are cash-rich and see property investment as a means to hedge against inflation. There are then others who are growing a portfolio through Buy, Refurb, Refinance and Rent (BRRR) who see property as a long-term investment, which is supported by economic history.

Auction lots are now reflecting the changing market. This month is the first time I've seen reduced prices more in line with what astute buy to let investors are willing to pay. Recent auctions have seen an increasing number of unsold lots, which for both seller and auction house are not good - this is changing and we now have a buyer's market.

My book is available in paperback, Kindle and audiobook. To purchase please click here

Property Sourcing Liverpool

Tuesday 27th June 2023

A busy day viewing investment properties in the forthcoming auctions. Many clients are building distressed assets portfolios with us, whether straightforward Liverpool buy-to-let or renovation and refinance.

The key factors to look for and examine are:

- Location

- Condition

- Discount to market value (through comparable properties, but also net yield)

- Forced appreciation value

- Rent reviews

- Legal pack

If you nail these factors, you will make a successful property investment decision.

Buy to Let Liverpool

Sunday 2nd July 2023

It's been a few days since I have been able to update the Property Investment Liverpool Diary. It's been very busy with new and existing client calls and viewing about 19 Liverpool property auction properties last week.

From that 19, I have three or four which may interest clients, with more viewings scheduled for next week. It's very important to sort the wheat from the chaff. The fact that a property is in an auction should make you undertake thorough due diligence. Further, some properties are not 'bargains' as many vendors have unrealistic ideas about price and current market conditions.

The essential news is that guide prices are lower than in previous auctions. That's significant and, as ever, presents an opportunity for the astute buy-to-let property investor.

I am increasingly amazed at how many people do not look at the outside of a building/property when viewing it. They leave their cars, rush into the property to take videos/pics, and then rush to the next viewing.

It's essential to look at the structure, whether there is any visible evidence of subsidence, whether the roof is OK and not sagging, and whether the windows are fitted well. It's basic stuff.

Property Renovation Refurbishment Liverpool

Wednesday 5th July 2023

I spent the day visiting the various property renovation and refurbishment projects underway for ourselves and clients across Liverpool and Wirral.

We took possession of a property investment in Wirral, which we had bought for a Buy, Refurbish, Refinance, Rent (BRRR) client in the last property auction and measured up for the new kitchen and bathroom. It's a sound property with a relatively new roof, and the refurbishment project is very straightforward. We aim to finish it quickly, as the client uses bridging finance arranged by our recommended broker. He will then refinance and move on to the next investment property while we will let and manage it. This type of property is the engine room of buy to let in Liverpool and Wirral and will have a double-digit yield.

Off-Market Property Deals Liverpool

Thursday 6th July 2023

Today has been spent in the office matching Liverpool buy to let investors with distressed off-market property deals. As I've said before, you do not find real off-market deals on websites, on lists or WhatsApp groups. Real deals are a personal telephone call from the property investment company brokering the deal. There are three people involved. The seller, buyer and broker.

The first off-market property investment of the day went to a regular client who almost buys a property per month. It was a fantastic house in L21, with a sitting tenant on a new 12-month AST, with a guaranteed rental. The yield is a respectable 9.4% on a property in excellent condition.

The second off-market property deal of the day went to a non-UK resident buy to let property investor with a yield of 12%.

These deals come in and go out more or less on the same day. I had another investor phone today asking for our off-market distressed assets property list. When I said we didn't have one, they sounded surprised. I pointed out that genuine deals don't get on a list, they're sold almost immediately.

My advice would be to avoid lists and special groups and look for property investment companies which will send only you a genuine deal.

Property Auctions Liverpool

Property Sourcing Liverpool

Saturday 8th July 2023

Property Sourcing Liverpool

Our first pre-auction offer of the month was accepted yesterday on an outstanding buy to let property investment in Liverpool. It has a new roof, a new boiler and the tenant who has lived there for many years has it immaculate. The tenant also has an excellent job which is not dependent on the state of the economy and wishes to remain in the property for the foreseeable future.

We were attracted by the location, the condition and obviously the price. The property is also under rented which was a factor when doing the financial analysis. The yield at the market rent is above 10%.

As a long-term buy to let investment it is one which will perform very well, and given its location, also gives the client options for an Airbnb* should they wish.

Buy to Let Liverpool

Property Investment Yield

Tuesday 11th July 2023

It is crucial, given the increasing interest rate environment, but also the opportunity to acquire buy to let property investments at distressed prices to understand the return or yield.

There is a short article here to help you:

22 July 2023

14% Yield

It's been a while since the last diary entry, as we have been exceptionally busy, mainly with property renovations and refurbishments and acquiring distressed assets for clients.

As highly leveraged buy-to-let investors have looked to exit the market, cash buyers have been waiting in the wings to pick up some excellent bargains, either through property auctions or off-market deals

We see similar market indicators to the post-Credit Crunch and Financial Crisis of 2008 plus. It's a buyer's market, and we have secured some excellent property investments for clients.

One such buy-to-let property investment is an unbroken freehold block of flats in Liverpool, which require very little work, individual apartments have gas central heating, and the yield is 14%.

Avoid Costly Property Mistakes

26th July 2023

We had a telephone call from an out-of-town buy to let property investor today to enquire whether we or one of our clients, wanted to buy a HMO he'd recently developed. It was bought at a property auction, then converted into a large HMO, complying with all the regulations and fully furnished.

I asked him if he had planning permission, given it was an Article 4 area.

He said, no.

I said, Whoops!

Right to Manage Liverpool

27th July 2023

We have successfully undertaken three Right to Manage (RTM) actions on behalf of leaseholders recently, two of which we completed last Monday. The RTM aims to reduce service charges and thereby increase capital values. A secondary aim is to increase the rents in the block by making the building's communal areas more attractive and welcoming.

But, there's a big issue.

There's no cash.

This is an issue many RTM companies face, but one which will not defeat us. This morning we are sending service charge demands to leaseholders and the journey to increase capital values and rents begins.

30th August 2023

After a well-earned summer holiday, we're back and straight into property refurbishment projects. This property was bought at auction recently and will undergo a refurbishment and possibly have an additional bedroom added in the roof.