Property Investment Liverpool

Market-Leading Property Sourcing – Liverpool

1. Start with a personal strategy Zoom with Dominic Farrell, designed around your goals, budget and risk profile. You've nothing to lose, it's free!

How It Works

2. Choose between guided property visits in Liverpool or a completely hands-free investment service.

3. Properties sourced pre-auction, at auction, post-auction or off-market — not inflated Rightmove or Zoopla stock.

4. Focus on below-market-value purchases delivering above-market rental yields.

What’s Included

5. Lettings & full property management included for 12 months, then just 7.95% ongoing.

6. Tenants sourced free in the first year.

7. Guaranteed Rent insurance included where applicable, with discounted continuation after 12 months.

8. Renovation and refurbishment works quoted before purchase and managed end-to-end by our team.

9. Access to market leading finance and mortgage broker.

10. Access to experienced legal team.

Why Work With Us?

We build long-term investor relationships, not one-off transactions. Our structured approach, local expertise and fully managed service is why this is one of the most comprehensive property sourcing packages in the market.

Book your strategy call today with Dominic Farrell and secure genuine below-market-value investment property in Liverpool.

Free Liverpool Investment Strategy Zoom with Dominic Farrell

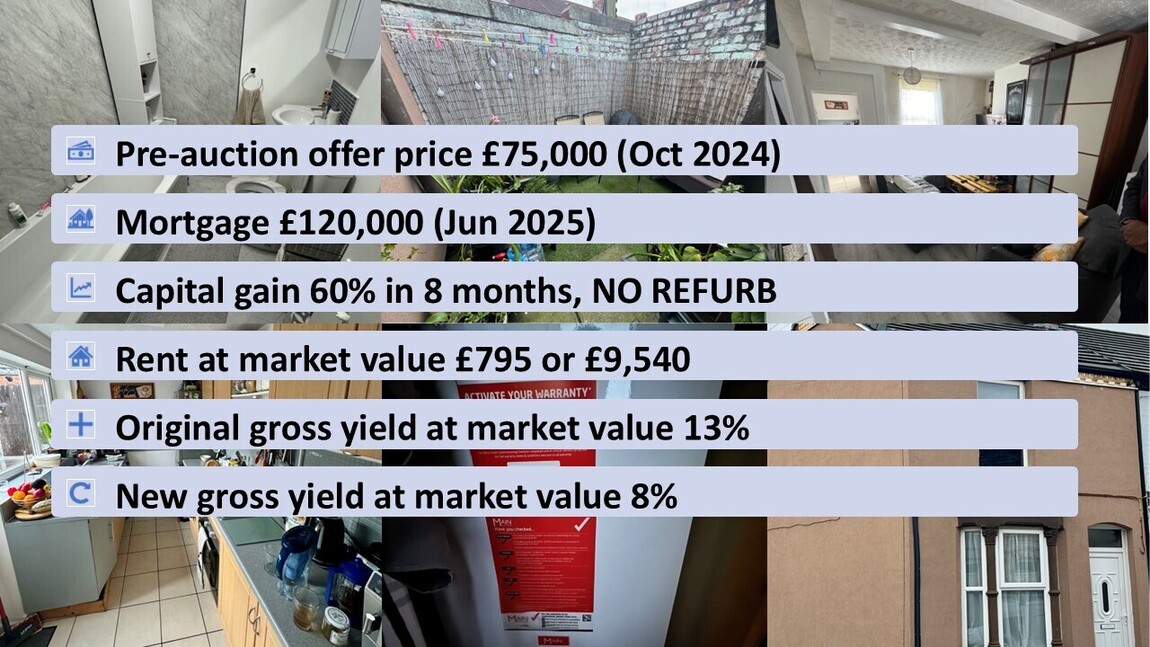

Recent Acquistion Prior To Auction - 2026

“Today I got a survey on my first property bought through working with Dominic. I paid 75k and my goal was to do a “no money left in” deal. To achieve my goal I needed the value to come back at 100k (borrowing 75% against a £100k valuation means I would get my original £75k investment back).

Well to my surprise the surveyor came back with a valuation of not £100k but 120k! That means I’m now able to borrow £120k x 75% = £90k from the bank. Put another way I’m getting all my original 75k back plus an extra £15k.

Put yet another way I’m getting all my original 75k back, paying for my mentorship fee in full, plus getting cash back on a property that I didn’t refurbish, has been paying me rent, has had no issues with tenants, and got a free EPC upgrade.

But if you want to know the truth that’s not what I paid the fee for.

The real value for me is the countless meetings, phone calls and text messages where I was told what was wrong with the property I was looking at, what to look for, and the major pitfalls to avoid in property, so I can position myself for success which come as part of the mentorship.

That’s what I can take with me for the rest of my life. The 15k cash back is just confirmation (not that I needed it) that I chose the right guy.

As with anything in life the “price” is what you pay, and the “value” is what you get.

Those who can only see price will never benefit from the value.

Thank you, Dominic.”

Conor.

If you're looking for Property Sourcing Liverpool, then please click here

"I bought my first-ever BRRR deal with Dom in October 2023. I found him via his distressed assets website and felt drawn to the concept of truly BMV properties. Dom was so helpful throughout the process. He viewed the property for me, secured the price pre-auction, and helped me throughout the conveyancing and insurance process. I bought the property for 75k and just got it revalued at 115k after 6 months, a 50%+ return. I've not done any work to the property, and the existing tenant is long-term and has looked after the property well.

I highly recommend Dom's services. As a London-based investor, it's so useful to have that local expertise in Liverpool and someone on the ground to view, make offers, and have pre-existing relationships with the auction houses. Once I refinance and build up some capital, I'll definitely be back!" K.P.

Property Investment Liverpool

A property investment in Liverpool should be sourced below market value and have a high net yield relative to comparable properties. The best property investments are generally those which are distressed, which means they are either repossessed by a bank, or there is another reason the owner must sell, and in some cases very quickly to raise cash.

Distressed Property UK

Undoubtedly, bargains are found where others need to sell and they are usually found at property auctions or through fixed-charge receivers (LPA receivers). Tuna Fish Property has extensive experience over many years buying repossessed property at auction and we can help you find exceptional investment property deals and distressed assets

Liverpool Property Investment

The largest market in most cities is the blue-collar worker. Liverpool is no different. There are only a finite number of jobs in cities like Liverpool where salaries are sufficient for many of the new build high-end apartments currently being built. There is a danger that the supply of some types of property, may exceed tenant demand. Operating costs are also a factor which we will discuss below.

Demand for good quality housing is high and this trend will continue. As with most products, if you stand out from the crowd, then the demand creates itself.

Liverpool Property Investment

Property Investment Liverpool

We source investment properties for UK and overseas clients in Liverpool and Wirral. Please see Property Sourcing Liverpool for further details and recent examples.

Buy-to-Let Property Investment in Liverpool

At Tuna Fish we stick to what we know, a tried and tested template developed over many years targeting individual postcodes, even specific roads and streets, in Liverpool and Wirral, aimed at our buoyant and growing market of tenants.

We create a unique selling point for tenants, by ensuring our properties stand out, and include all white goods as standard.

We don't follow the latest fads but have a Warren Buffet approach to property investment in Liverpool.

"Price is what you pay. Value is what you get."

Tuna Fish is driven by return on investment and net income and this goal is the basis of our long-term strategy, personally and for clients. In other words, buy to let property investments focussed on yield.

Buy, Refurb, Refinance, Rent (BRRR)

We have a team in place to guide you through a buy, refurb, refinance and rentstrategy. Further details are here BRRR

Property Auctions Liverpool

Amazon No.1 Bestseller - 3rd Edition 2025

New property investment book for 2025 written by Tuna Fish Property director and Head of Property Investment and Sourcing Liverpool

If you want to understand our track record, please read our latest property investment book going back to the financial crisis of 2008. There are many lessons and strategies which are applicable to acquiring investment properties 2025. Many of the properties we source for clients in Liverpool are well below market value with high rental yields. Some are illustrated in the book and on this website. Please call us to discuss.

Whether you're completely new to property auctions and buy-to-let property investment or a seasoned investor, Property Auctions: Repossessions, Bankruptcies and Bargain Properties contains the expert information, insight, and guidance you need to improve your skill and profits in any market climate. Whatever your interest in property investment; whether you want a quick return or maybe to fund your retirement long-term, Property Auctions will give you the skills to achieve your financial goals, and not just in rising markets but all market conditions; rising, falling or stagnating.

This book demystifies the acquisition of 'distressed' properties at auction and shows you how to make money whatever the economic weather. It brings together all of the key concepts that successful property auction investors focus on which, when combined, will give you a solid platform on which to base investment decisions.

The first part of the book details the tools and techniques to help you identify, analyse and filter investment properties, shortlisting your targets. The second part takes you through the actual viewing and buying process and the tactics involved to be a successful property investor or developer.

Property Auctions also gives clear, concise and detailed guidance on raising finance and the auction legal process - two essential components of the property investment journey which are key to success. All the principles are fully evidenced with real-world case-studies to show how the theory works in practice.

There is no better place to purchase below-market-value properties, whether to hold for the long-term or develop, add-value and sell.

Why Buy to Let in Liverpool?

Why invest in Liverpool property?

There are several reasons why investing in Liverpool property can be a good option. Here are some key points:

1. Strong Rental Market: Liverpool has a strong rental market due to its large student population from various universities and educational institutions. This makes it an attractive location for buy-to-let investments, as there is a consistent demand for rental properties.

2. Regeneration and Development: Liverpool has experienced significant regeneration and development in recent years, with ongoing projects like the Liverpool Waters and the Knowledge Quarter driving economic growth and creating new opportunities for Liverpool property investment. This development and investment will lead to capital growth and increased rents in the medium to long term.

3. Affordable Property Prices: Compared to other major UK cities like London, Birmingham and Manchester, Liverpool offers relatively affordable property prices, making it an attractive option to buy to let investors looking for value for money. Lower property prices can result in higher rental yields and the potential for capital appreciation over time.

4. Strong Economic Growth: Liverpool's economy has been steadily growing in recent years, with a diverse range of industries, including maritime, manufacturing, creative arts, and tourism. The city has also seen significant investment in infrastructure, including the Port of Liverpool, which is one of the busiest ports in the UK. A strong economy contributes to a stable property market and creates opportunities for buy to let property investors.

5. International Tourist Destination: Liverpool is a popular tourist destination, known for its rich cultural heritage, music scene, and waterfront attractions, such as the waterfront and iconic Albert Dock. This creates demand for short-term rentals, serviced apartments, and other tourist accommodation, making it a potential investment opportunity for those interested in the hospitality sector.

6. Transportation Links: Liverpool has excellent transportation links, including the Liverpool Lime Street railway station, Liverpool John Lennon Airport, and the Merseyrail network, providing connectivity within the city and to other parts of the UK. Good transportation links can enhance the accessibility and desirability of a location for property investment.

7. Diversification: Investing in Liverpool property can provide diversification to a property investment portfolio, spreading risk across different locations and markets. This can be beneficial for risk management and potentially yield better returns.

It's important to note that property investment carries risks and it's crucial to conduct thorough research, seek professional advice, and assess your personal financial situation before making any investment decision.

Tuna Fish Property can help.

Property Investment Liverpool

Many buy to let property investors ask us. 'Where is the best area to invest in property in Liverpool?' They also ask, 'What is the best type of property investment in Liverpool?' In our view, based on experience, apart from a few specific areas and roads, the Liverpool property investment market, can be defined by the type of property, not the area. Buy to let property investors in Liverpool are faced with a number of options. They are:

Investment Property Liverpool - A Strategy

One of the biggest mistakes buy to let property investors in Liverpool, or anywhere else for that matter make, is by approaching property investment haphazardly and not formulating an investment strategy at the beginning of their journey. What are the key investment considerations?

Property Development Liverpool

Tuna Fish Property has bought properties at auction and developed them over many years. The example below was purchased and then developed into 6 apartments adding significant value. All 6 apartments, including the freehold, were sold. This is a good example of buying to flip. The property is in Buckingham Road L13.

Tuna Fish can source investment properties for clients to flip and/or develop and add value. We can assist with all aspects of the renovation or refurbishment and undertake the works should you wish.

Investment Property Liverpool

Our property investor clients have different strategies and we can assist with any, whether it's the purchase of commercial property, standard buy to let or development projects.

This property development project was acquired for just £48/sq ft in a decent part of Liverpool and will provide the investor with a number of options from conversion into flats, a large HMO or retaining it as a large family dwelling. The options are excellent, as well as the acquisition price.

Tuna Fish Property will undertake the planning and works, and then let and manage the property (or properties) for the client who is building his portfolio with us.

What is property development?

Property development can vary depending on the specific project and location, but generally involves the following steps:

1. Project selection: The first step in property development is identifying a suitable project. This may involve researching the local property market, evaluating potential properties based on planning regulations, and considering factors such as location, accessibility, and availability of utilities.

2. Feasibility study: Once a project has been identified, developers will conduct a feasibility study to determine if it is financially viable. This may involve evaluating the cost of land acquisition, construction, and marketing, as well as estimating the potential return on investment.

3. Planning and design: If the project is deemed feasible, the next step is to develop a detailed plan and design for the property. This may involve working with architects, engineers, and other professionals to develop ideas, site plans, and other design documents.

4. Financing: Property development requires significant upfront capital, so developers will need to secure financing from investors, banks, or other sources. This may involve preparing a detailed business plan and financial projections to present to potential lenders or investors.

5. Construction: With financing in place, developers will begin construction on the property. This may involve hiring contractors, managing the construction process, and ensuring that the project is completed on time and within budget.

6. Marketing and sales: Once the property is complete, developers will need to market it to potential buyers or tenants. This may involve working with agents, advertising the property online and in print, and hosting open houses or other events to attract buyers.

7. Property management: If the property is let rather than sold, developers may also need to manage the property after it is completed. This may involve hiring property managers, maintaining the property, and ensuring that tenants are satisfied and paying rent on time.

Overall, property development can be a complex and time-consuming process, requiring a range of skills and expertise. However, with careful planning, financing, and execution, it can also be a highly rewarding and profitable business.

Tuna Fish Property can help